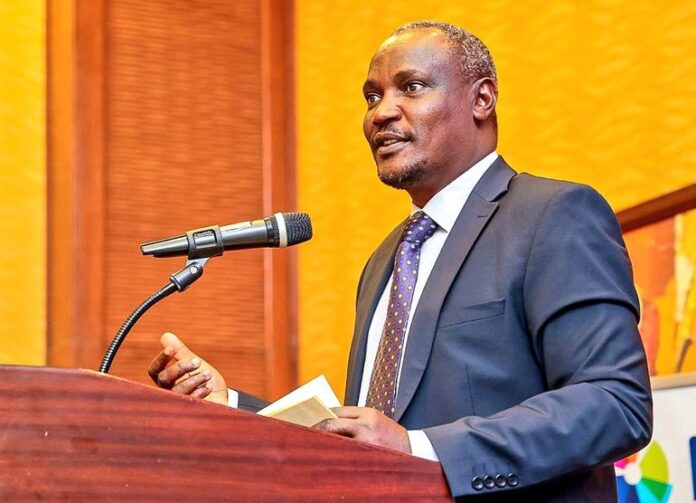

Treasury Cabinet Secretary John Mbadi has announced plans for tax relief for people earning below Ksh30,000 per month.

Speaking during a forum on Sunday, February 1, 2026, in Kiambu, Mbadi said the government would also reduce taxes for those earning below Ksh50,000, aiming to ease the burden on salaried Kenyans.

The forum at Kiambu National Polytechnic was part of the Budget and Privatisation Public Engagement Forum for Kiambu County.

Mbadi focused on government plans to privatise state-owned companies and use the proceeds to fund infrastructure and provide tax cuts.

The Cabinet Secretary highlighted the strain on Kenya’s middle class and salaried workers, noting that about 3.5 million Kenyans rely on salaries and bear most of the tax burden.

“Those salaried Kenyans, we have 3.5 million Kenyans earning salary. They are carrying the burden on almost everybody. It is not fair. We have decided I am taking proposal amendment to Bunge. I am not even waiting for finance bill. Anybody earning below 30,000 in this country should pay zero tax. Zero,” he stated.

For those earning below Ksh50,000, the government will lower tax rates. Mbadi said the measures aim to put more money in people’s pockets and stimulate demand. He cited signs of economic slowdown, including reduced consumer spending.

“And anyone earning below 50,000 in this country, we are going to reduce tax. And this the government has decided. We have sat down with the President and we have agreed. We want to give you something in your pocket so that you can spur demand in the economy,” he added.

“Because we have looked at the economy and we can see the economy choking. Because people don’t have money in their pockets to buy from you people. Hakuna mtu ananunua mboga. Badala ya kununua mboga ya sasa hivi mtu anakuja kununua mboga four leaves.”