Kenyans are learning the truth of the old adage that taxes – along with death – are the only two certainties of life.

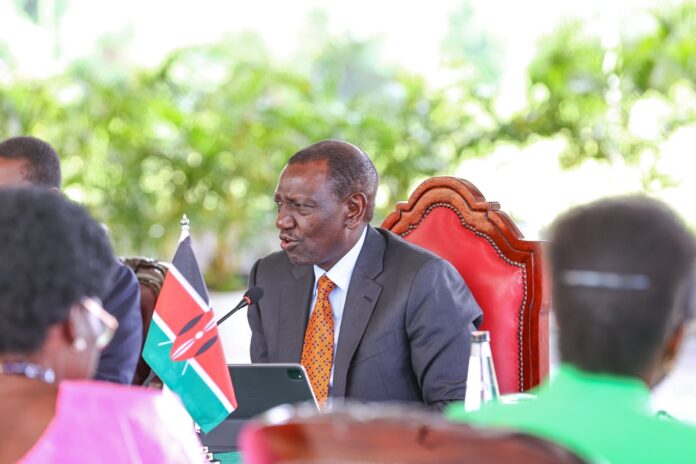

This is because President William Ruto is trying to convince them that they should hand over more of their hard-earned cash, saying that, if anything, they are under-taxed.

He recently argued that Kenyans have “been socialised to believe they pay the highest taxes” when in fact, he added, the overall tax burden was lower compared to some other countries in Africa and beyond.

“We must be able to enhance our taxes,” he said, but acknowledged that it was “going to be difficult”.

Since he was elected president in August 2022, Mr Ruto’s government has raised a host of taxes while also introducing new ones.

Taxes on salaries have gone up, the sales tax on fuel has doubled and people are also paying a new housing levy and are due to pay more for health insurance.

Mr Ruto’s message is that if people want better public services and a reduction in the country’s debt burden then they have to pay up.

But many are angry.

The imposition of some of the new taxes, amid the rising cost of living, led to deadly street protests last year.

Today, ordinary conversations are often dominated by the pain of taxation, and the president’s view has exasperated Kenyans who already feel overburdened.

Mr Ruto said that last year government tax revenue amounted to 14% of the value of the economy as a whole, a figure that is known as the tax-to-GDP ratio, whereas the number for Kenya’s “peers in the continent is on average between 22% and 25%”.

This “means our taxes are way below those of our peers”, the president insisted.

However, it was not exactly clear which countries he meant by “peers”. While it is true that South Africa, Morocco, Mauritius and Namibia all have tax-to-GDP ratios close to or higher than 20%, many others, including Nigeria, Ghana, Uganda, Tanzania and Zambia, do not.

According to an African Union report, in 2021 the average for the continent as a whole was 15.6% – not much higher than Kenya’s.

Opposition figure and lawyer Miguna Miguna summed up the incredulity that many felt.

“Kenyans are overtaxed, repressed, exploited and abused,” he posted on X, formerly Twitter, adding that people “don’t receive even 1% worth of value from our taxes!”

Despite the uproar, more taxes will be coming – the president has made a case for increasing taxes in the next couple of years to at least a 20% of GDP by the end of his term in 2027.

He has defended the raising of more taxes in order to boost government revenue and reduce borrowing. Kenya has a national debt of nearly $80bn (£62bn) much of it inherited from previous administrations.

“The last regime went on a borrowing spree. Our regime is balancing, paying off debts plus re-generating the economy,” government spokesman Isaac Mwaura told the BBC.

Already, the government’s budget proposal for the next financial year introduces new measures that seem unpopular, including a mandatory tax for car owners and sales taxes on bread as well as financial transactions.

But economist Odhiambo Ramogi argues that focusing on the tax-to-GDP ratio is the wrong remedy.

He says that rather than taxes being too low, tax collection is inefficient and poor governance means that a lot of state spending goes to waste.

The economist points out that despite taxes going up the tax-to-GDP ratio has actually fallen, suggesting that more people are withholding their money.

He attributes this to the effect of the “Laffer curve” – a theory that tries to explain the relationship between taxes and revenue. It suggests that when they go beyond a certain point they reduce people’s incentive to work and pay up.

“High tax rates naturally lead to low collection,” he says.

Mr Ramogi says that countries in the West with high tax rates generally have good public services to show for it.

In contrast, he argues, despite there being many taxes and levies waiting for Kenyans, people still have to “pay school fees, hospital bills, you have to pay for all public services, it’s double taxation all across the board”.

He says that in order to grow, Kenya should first ensure taxes are properly collected and utilised, as well as eliminate corruption – a problem which the government spokesman says President Ruto is already “very clear” in addressing.

Ken Gichinga, the chief executive of analyst firm Mentoria Economics, adds that higher taxes may be self-defeating as they increase the cost of doing business, which leads to closures, job losses and subsequently a reduction in the amount raised from income tax.

There are also some who challenge the logic of the president’s case that raising the tax burden to match some other African countries will necessarily produce a better economic outcome.

Economist and former MP Billow Kerrow mentions two of Africa’s largest economies: Nigeria, which in 2021 had a low tax-to-GDP ratio, and South Africa, which had one of the highest on the continent. In other words, the tax rate is not an indication of the strength of an economy.

“The crazy focus by the government on tax is completely misleading,” Mr Kerrow told KTN television.

But the president appears determined.

“I have a lot of explaining to do,” he said.

“People will complain but I know finally they will appreciate… We have to begin to live within our means.”