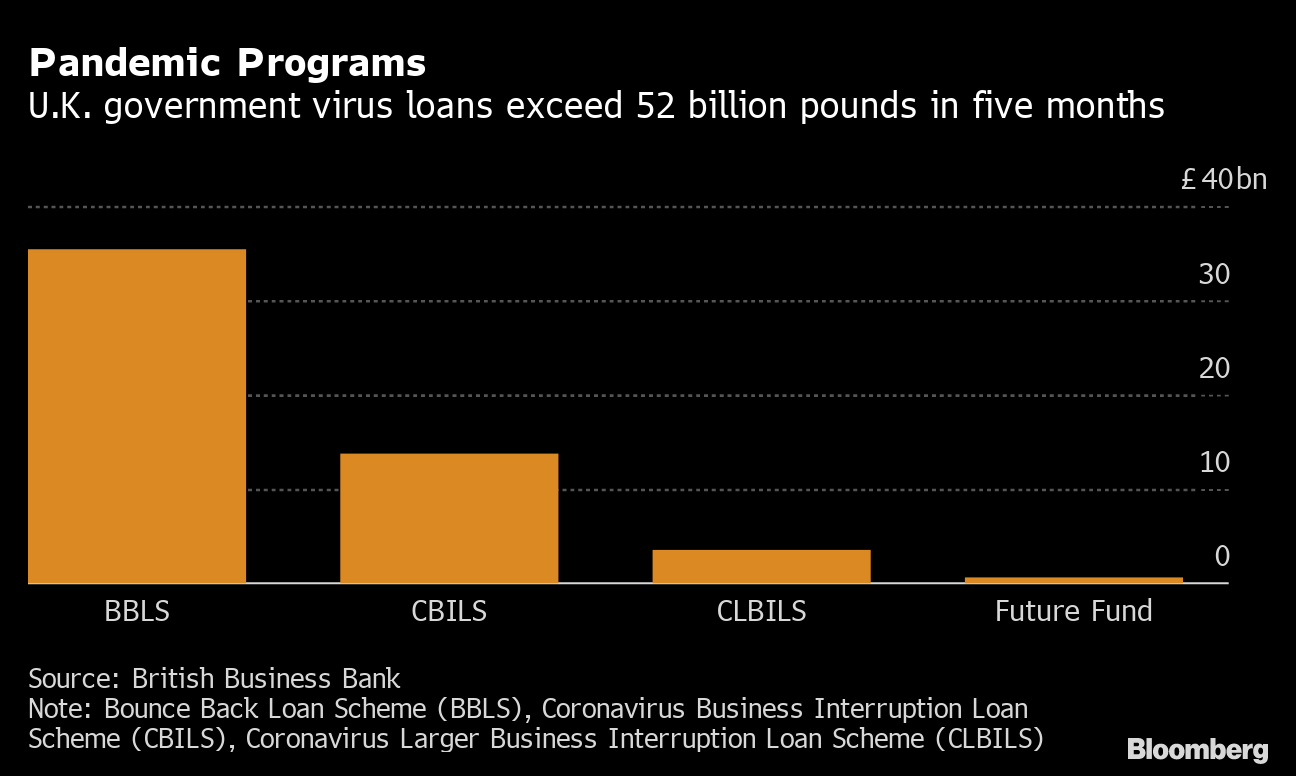

UK criminals have joined their Kenyan counterparts in stealing Covid-19 billions as the effects of the pandemic come home to roost. – By BBC and Joseph Mukala

While in Kenya Covid-19 gangsters used the health supply and procurement at KeMSA, in the UK, banks were raided and culprits walked with billions of cash set aside as loans for the vulnerable.

In the land of Queen Elizabeth, the criminals stashed away a cool Sh.265 billion, starving hustlers and SMEs of their livelihood, at a time when the global economy is reeling.

A loan scheme for struggling small businesses suggests criminals could have stolen more than £1.9bn from taxpayers.

The United Kingdom’s The National Audit Office said in a report that the UK’s five biggest banks will pocket nearly £1bn between them from the scheme.

Under the Bounce Back scheme, small businesses can borrow up to £50,000.

The government said it has tried to minimise fraud through lenders’ background checks.

Bounce back loans are 100% government-backed loans of up to £50,000, and were introduced to mitigate the huge pressure on small businesses after the economy went into coronavirus lockdown.

They do not have to be paid off for six years, and are interest-free for the first 12 months.

The £38bn loan scheme is an extension of earlier offers which some businesses complained they could not access as the lending criteria was too strict.

The Public Accounts Committee said it was the government’s largest and most risky business support scheme.

It says it will not assess the value-for-money of the scheme, as the loans will not start being paid back until May next year.

The NAO analysis said losses from the scheme are likely to reach “significantly above” normal estimates for public-sector fraud of 0.5% to 5%.

This would mean that more than £1.9bn had been lost to criminals, leaving taxpayers on the hook when they failed to pay the money back, it said.

‘Taxpayer’s expense’

Meg Hillier, chair of the Public Accounts Committee, said the loans had been a vital lifeline for many businesses.

But she added that “the government estimates that up to 60% of the loans could turn bad – this would be a truly eye-watering loss of public money”.

“The bounce back loan scheme got money into the hands of small businesses quickly, and will have stopped some from going under.

“But the scheme’s hasty launch means criminals may have helped themselves to billions of pounds at the taxpayer’s expense.

“Sadly, many firms won’t be able to repay their loans and the banks will be quick to wash their hands of the problem.