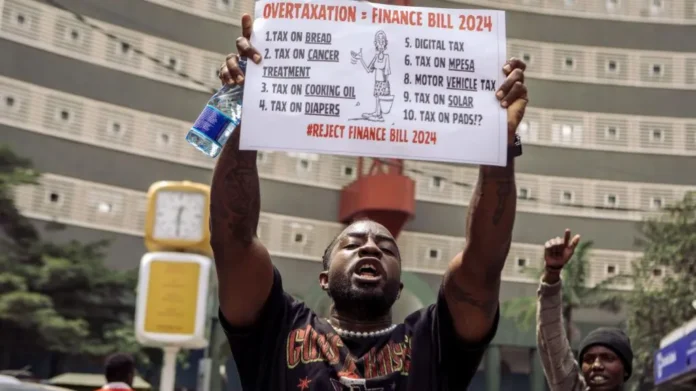

Kenyans are protesting over a new finance bill that introduces unpopular tax proposals that have drawn a lot of anger across the nation.

The controversial bill, which has provisions that are seen as imposing extra burdens on ordinary citizens and businesses, has sparked a huge outcry from a public already burdened with a high cost of living.

It has sparked youth-led protests, which, though largely peaceful, have led to at least one death and hundreds of injuries as well as arrests – all of which have been condemned by lawyers and human rights groups.

The government has dropped some of the contentious proposals, but it has done little to assuage public anger.

Many now want the entire bill scrapped.

On social media, there have been calls for protest and demands that lawmakers oppose the tax increases.

What were some of the original plans that sparked anger ?

- Taxes on basic items

Amendments to the bill look set to be approved but some of the controversial provisions initially put forward included a plan to introduce a 16% sales tax on bread and 25% duty on cooking oil.

There was also a planned increase in the tax on financial transactions as well as a new annual tax on vehicle ownership amounting to 2.5% of the value of the vehicle.

The government said it was dropping these measures amid a public outcry.

- The eco levy

The eco levy, described as a charge on products that contribute to e-waste and harm the environment, was another key provision of the bill that the government has now suggested amendments to.

Critics pointed out that it would lead to the increase in the cost of essential items such as sanitary pads, which was seen as insensitive, as there are many girls who, unable to afford these products, often miss school during their periods.

Babies’ nappies would also be affected.

Following an outcry, the government said the levy would apply only on imported products, arguing that this would the boost growth of local industries.

The other key target of this eco levy is digital products, including mobile phones, cameras and recording equipment as well as TV and radio equipment. A rise in the cost of these products is seen as harmful to the growth of the digital economy, which many Kenyans rely on for their livelihoods.

What are some of the measures that remain untouched?

- Tax on specialised hospitals

The finance bill introduces a 16% tax on goods and services for the direct and exclusive use in the construction and equipping of specialised hospitals with a minimum bed capacity of 50.

Many Kenyans have been apprehensive that this could mean higher costs to access critical health services for cancer, diabetes, kidney dialysis or other chronic illnesses.

The chairman of the parliamentary finance committee, Kuria Kimani, has dismissed claims that “the bill introduces taxation on cancer patients” terming them in parliament as “falsehoods to emotionalise the public”.

- Higher import fees

The bill proposes to increase the rate of import taxes from 2.5% to 3% of the value of the item, to be paid by the importer at the port.

The rise comes just a year after the rate was reduced from 3.5% to 2.5%. The change is expected to generate additional revenue for government but could also lead to higher prices for imported products.

What has been the government response?

As well as withdrawing some of the most controversial measures, President William Ruto has acknowledged the protests and promised he will hold talks to address the concerns of the youth who are at the forefront of the demonstrations.

But that has done little to calm tensions.

Why is this not seen as being good enough?

Despite the axing of some of the proposed measures, others remain – including the higher import tax and an increase in the road maintenance levy that is charged on fuel.

But this is also about a sense of anger that has been simmering over a long period.

Some exasperated Kenyans, who feel they are overtaxed, do not think the government has been taking their concerns into consideration.

Mr Ruto has argued that compared to some other African countries Kenya has a relatively low tax rate – but this did not convince many.

Everyday conversations, which were already dominated by the pain of taxation, have now reached a crescendo.

This year’s finance bill was not the first unpopular one under Mr Ruto.

Last year’s equivalent, which also sparked protests, introduced a slew of unpopular taxes that the current plan adds to, worsening the pain.

Angry protesters would rather the government to reduce its spending, just as many Kenyans have had to in the lean economic times, and address wastage and corruption.

The government has in the past said it was pursuing that but has been unable to persuade many that enough is being done.

What happens next?

On Tuesday, lawmakers is considering and voting for the government’s amendments to parts of the draft law, which was approved by parliament last week.

The governing coalition has enough numbers in parliament to allow the amended bill to sail through. After it is passed, the president would have to sign it into law within 14 days or send it back to parliament with a proposal for further amendments.

Though unlikely, the government could also opt for other measures in a bid to defuse the pressure, including deferring the bill.

(Story by BBC)